Guiding Lights,

Seizing Opportunities

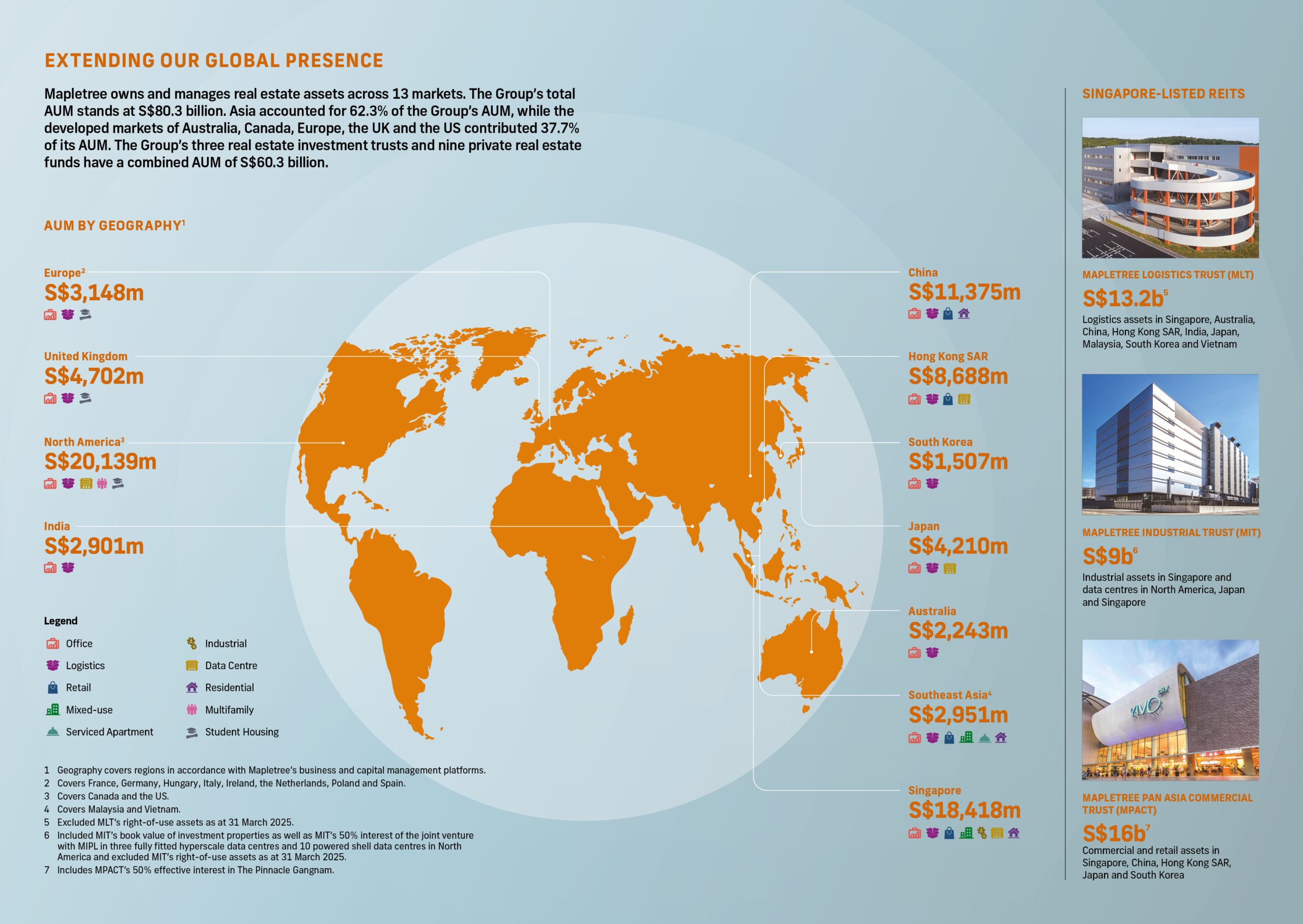

In Financial Year 2024/2025 (FY24/25), the Group remained focused on improving its operational performance while being disciplined in executing its expansion plans through strategic portfolio acquisitions in core sectors (logistics, student housing, office and data centre) and increasing development activity to build for the future.

Financial Highlights

S$80.3B

Assets Under Management (AUM)

S$2,229.1M

Revenue

S$637.4M

Recurring Profit After Taxes And Minority Interests (PATMI)

S$5.5B

Projects Under Development

Message from the Chairman

“In the months ahead, market conditions are expected to remain tough amid ongoing uncertainties. Notwithstanding, we are ready to adapt and have identified potential growth opportunities in selected markets. As a Group, we will continue to strengthen our focus on our four core sectors – logistics, student housing, office and data centre – in geographies where we see promising long-term prospects.”

Mapletree has demonstrated its resilience in a year marked by high interest rates, market uncertainties and an evolving economic landscape. Looking back on Financial Year 2024/2025 (FY24/25), the Group has effectively pursued its strategic goals with discipline, adaptability and a forward-thinking approach.

The current global trade environment is characterised by high volatility, largely due to geopolitical tensions and the ongoing tariff wars. These circumstances have led to changes in trade policies and are reshaping economic relationships on a global scale, subsequently affecting market confidence.

Global growth is still struggling, lagging behind the levels we saw before the pandemic hit. While some advanced economies are showing signs of recovery, many developing countries are still dealing with the lasting effects of the pandemic.

Against this backdrop, Mapletree has successfully navigated these difficulties by prioritising operational stability, acquiring strategically across core sectors in selected markets, and proactively managing our capital. We are committed to delivering sustainable growth to our stakeholders with a focus on both short and longer-term goals.

In the months ahead, market conditions are expected to remain tough amid ongoing uncertainties. Notwithstanding, we are ready to adapt and have identified potential growth opportunities in selected markets. As a Group, we will continue to strengthen our focus on our four core sectors – logistics, student housing, office and data centre – in geographies where we see promising long-term prospects.

Read the full message

Message from the Group Chief Executive Officer

“As we prioritise achieving operational excellence for our existing assets, we continue to build for value creation in the future. Moving forward, we strive to deepen collaborations with like-minded capital partners on new funds and syndication, while continuing to invest into the various asset classes and markets identified for long-term growth. We would like to thank our stakeholders for your continued trust and support as we remain steadfast in fostering sustainable growth in the long term.”

Amid the challenging market conditions, Mapletree delivered a resilient performance in FY24/25 with a revenue of S$2.2 billion and a recurring PATMI of S$637.4 million. Stable operational results, supported by the Group’s strategic acquisitions and asset recycling activities, have continued to provide a solid foundation for our business.

The Group recorded total net proceeds of S$897 million from successful divestment of non-core assets as well as other divestments to Mapletree Logistics Trust and the syndication of Mapletree Japan Investment Country Private Trust, the Group’s third Japan-focused private fund. Overall, the Group’s PATMI recovered from a net loss a year ago to a profit of S$227.2 million in FY24/25 as asset valuation losses narrowed.

For this FY, the Group focused on strategic portfolio acquisitions in defensive sectors, pivoting towards opportunities aligned with our long-term growth objectives. Our AUM grew from S$77.5 billion in FY23/24 to S$80.3 billion in FY24/25. Our managed AUM remained at S$60.3 billion while owned AUM grew on the back of the strategic acquisitions, leading to a lower AUM ratio of 3x in FY24/25.

Besides deepening our exposure in resilient asset classes, we continued to build for the future, with projects under development standing at S$5.5 billion as at 31 March 2025, compared to S$3.7 billion a year ago. Having honed our development capabilities over the years, we are now leveraging our expertise to increase the value-add to our portfolio. Development projects allow us to achieve better returns with higher yields on costs and enable us to bring higher quality products to the market.

In addition, the Group continued to prioritise balance sheet optimisation by adopting proactive capital management and hedging strategies to mitigate the impact of elevated interest rates and global economic uncertainties. Despite executing several strategic acquisitions in FY24/25, the Group recorded a healthy interest cover ratio at 2.6x of net finance costs. Mapletree’s ability to capture new opportunities remained robust, with access to cash and undrawn facilities amounting to S$9.2 billion as at 31 March 2025 to fund future acquisitions.

Overall, these results reflected Mapletree’s disciplined and prudent approach in executing our business plans despite a challenging environment marked by elevated interest rates, intensifying geopolitical tensions, and an increasingly uncertain global economic backdrop, which has since escalated even further amid the ongoing tariff wars.

Highlights of the Year

- Mar 2025

- Feb 2025

- Jan 2025

- Dec 2024

- Nov 2024

- Oct 2024

- Sep 2024

- Aug 2024

- Jul 2024

- Jun 2024

- May 2024

- Apr 2024

Mapletree secured a 44,318 sqm land parcel for logistics development in Tsing Yi, Hong Kong SAR, with construction expected to commence by mid-2026.

Mapletree was named Logistics Investor of the Year: APAC, at the Private Equity Real Estate Awards 2024.

In FY24/25, Mapletree Logistics Trust executed 14 divestments in Singapore, Malaysia, Japan and China for S$209 million and redeployed the capital into investments of modern, high-specification assets as part of its portfolio rejuvenation strategy.

Mapletree and Singapore Chinese Orchestra (SCO) presented a lunchtime concert featuring a repertoire of musical pieces at Alexandra Retail Centre (ARC), Singapore.

To commemorate International Women’s Day (IWD), Mapletree organised a wellness talk to raise awareness of perimenopause and a nature walk with the official colour theme, purple. Attended by 310 employees, these initiatives aimed to support IWD’s cause of fostering a more inclusive workplace.

Close to 100 secondary school and Institutes of Higher Learning students participated in the third edition of Mapletree x NP Hack, with the top four teams winning cash prizes totalling S$6,500 sponsored by Mapletree.

In support of World Water Day, Mapletree organised activities and workshops across various properties to educate its staff and tenants on responsible water use and practical conservation tips. At ARC, Singapore, participants took part in games promoting environmental awareness and conservation tips while completing a bingo card. In China, Mapletree’s tenants participated in a water-themed game at Gateway Plaza, as well as created micro water landscapes to highlight the importance of saving water at Sandhill Plaza.

Mapletree acquired its second United Kingdom (UK) warehouse, Verda Park, a 14,000 sqm multi-let Grade A logistics facility located in South Oxfordshire, the UK.

Mapletree launched its revamped Group website (www.mapletree.com.sg) which delivers an improved user experience featuring a fresh and modern look, updated and streamlined content, and advanced search function. The new Private Capital Management microsite (www.mapletreeprivatecapital.com) was also launched at the same time, as part of the Group’s efforts to enhance investor engagement and increase accessibility to information about Mapletree’s private funds platform..

Mapletree acquired a portfolio of 10 warehouses totalling 195,000 sqm of net lettable area situated in core logistics hubs across Spain.

Mapletree completed the construction of Mapletree (Hoskote) Logistics Park in Bengaluru, India, a development pre-certified with a Silver Rating by the India Green Building Council.

Mapletree launched Mapletree Art with a Purpose, through which three Singaporean artists were commissioned to illustrate Pop-Up Postcards featuring six MBC art installations and artefacts. Proceeds from the Postcard sales will be channelled towards funding essential programmes for Beyond Social Services and Boys’ Town and the artists’ royalties.

For the first time, Mapletree sponsored Singapore University of Technology and Design’s RoboRoarZ Singapore 2025, a design-centred reconfigurable robotics competition which attracted over 450 students to learn to solve real-world problems through technology.

Mapletree acquired a land parcel in Hanoi to develop a ~92,000 sqm Grade A mixed-use office project with retail amenities.

Mapletree acquired a 91,135 sqm site in New Jersey, the US, to develop a state-of-the-art 23,225 sqm logistics facility.

SC VivoCity was the first shopping mall in Vietnam to be awarded the LEED Gold Certification for Existing Buildings: Operations and Maintenance by the U.S. Green Building Council.

Mapletree continued its annual sponsorship of the Mapletree-SCCCI River Hongbao (RHB) Hackathon for the seventh consecutive year. Ten finalists were shortlisted from the 32 student teams to present solutions to social challenges. Each of the top four teams was awarded S$2,000 in prize money, S$5,000 in seed funding and the opportunity to run a stall at the RHB Carnival 2025. The most innovative and best pitch teams also won S$500 in prize money respectively.

Mapletree was named one of the Top 10 Best Performing Logistics Real Estate Operators in China by Guandian Organisation.

Mapletree entered the UK logistics market with the acquisition of Derby DC1, a 58,000 sqm logistics facility in Derby Commercial Park, the UK.

The fourth Mapletree Real Estate Forum at Singapore Management University (SMU) saw more than 70 SMU students, industry professionals and members of the public learning about student housing trends and challenges from speaker Mr Matt Walker, Chief Executive Officer, Student Housing, Mapletree, and panellist Ms Joy Wang, Head of ASEAN Equity Research and ASEAN Property at HSBC Bank.

For the sixth year running, Mapletree supported the 40th Singapore Bird Race which drew more than 400 birdwatchers and photographers, and nearly 100 students, to observe and record over 140 species of birds.

A total of 81 Mapletree employees and 90 Kent Ridge Secondary School (KRSS) students planted 300 trees across 50 species at KRSS to form a mini forest to promote environmental science and sustainability learning.

Mapletree presented an urban sketching exhibition Art & Artists Among Us at ARC which showcased 22 sketches depicting everyday life at Mapletree Business City (MBC), submitted by Urban Sketchers Singapore and the MBC working populace.

Mapletree Industrial Trust acquired a freehold mixed-use facility in Tokyo, Japan at a purchase consideration of JPY14.5 billion (~S$129.8 million), for future redevelopment opportunity into a new data centre.

Mapletree received the Best Private Housing (UK and Ireland) Award at the 2024 Global Student Living Awards in London, the UK.

The Bay Hub, a landmark office property measuring 57,975 sqm in the Kowloon East business district of Hong Kong SAR, had undergone a significant asset enhancement initiative, resulting in a welcoming experience with a seamless design that enhances comfort for tenants and visitors.

The inaugural Mapletree Annual Sustainability Lecture, delivered by famed British designer, Mr Thomas Heatherwick imparted insights on mindful building design and development to more than 200 attendees from Mapletree, Nanyang Technological University, Singapore, and the academia, the government and private sectors.

The Wild Birds and Mammals of Vietnam photography exhibition took place at SC VivoCity in Ho Chi Minh City, Vietnam from 12 October to 17 October. Focusing on endangered birds and mammal species, the exhibition is a culmination of a two month-long competition that attracted photographers throughout the country.

Mapletree organised its inaugural Investor Summit Eye on Asia: Emerging Opportunities together with abcIMPACT and SeaTown Holdings International, which was attended by more than 70 institutional investors and partners comprising C-suite and senior management personnel. Attendees gleaned insights on Asia’s dynamic landscape through dialogues with key industry personnel from Mapletree, abcIMPACT, NUS, SeaTown Holdings International and Temasek.

Themed “Art, Culture and Community”, the second edition of An Evening with Mapletree gathered more than 500 Mapletree employees, tenants and members of the Alexandra Precinct community to celebrate Mid-Autumn Festival through cultural and artistic activities at MBC.

To celebrate the same occasion, Mapletree presented the fifth Once Upon a Full Moon annual concert series from 13 September to 15 September, during which The TENG Ensemble and local singer-songwriter Charlie Lim performed original compositions to over 2,100 attendees at VivoCity, Singapore.

The second edition of Mapletree Community Month attracted over 460 Mapletree employees and tenant staff from 32 tenant companies to dedicate over 360 volunteer and learning hours to an array of activities at Mapletree properties, collectively raising S$21,000 for its long-time youth beneficiaries Boys’ Town and Beyond Social Services.

The Reef at King’s Dock, a 429-unit residential luxury development in Singapore, obtained its Temporary Occupation Permit with all units sold.

Mapletree and Marriott International, Inc. signed an agreement to operate the Group’s hotel and serviced apartments in HCMC, Vietnam, under JW Marriott and Hotel & Suites Saigon.

The accretive divestment of Mapletree Anson concluded on 31 July 2024, successfully delivering financial benefits and strengthening Mapletree Pan Asia Commercial Trust’s (MPACT) capital structure. The consideration of S$775 million secured a S$10 million gain over the property’s independent valuation of S$765 million, and a S$95 million gain over the original purchase price of S$680 million.

Held from 11 June to 13 June, the sixth Mapletree Youth Futsal Camp saw a record number of participants – 99 children of Mapletree’s tenants, employees and beneficiaries – sharpening their dribbling, passing and shooting skills with guidance from futsal coaches.

For the fifth year running, Mapletree supported The Mapletree Challenge organised by Singapore Institute of Technology, empowering students to create innovative solutions promoting sustainability. Besides being the venue sponsor, Mapletree sponsored the top three teams with cash prizes of S$8,000, S$5,000 and S$3,000.

More than 120 nature lovers and photographers took part in the inaugural Vietnam Bird Race organised by Tràm Chim National Park, WildTour, Vietnam Wildlife Photography Club and BirdLife International. With sponsorship from Mapletree and Canon Vietnam, and support from Lexar and BH Asia, the event also saw 80 children participating in an art competition focusing on the birds of Vietnam, an onsite bird photography exhibition and a nature walk into the Tràm Chim wetlands.

In collaboration with SCO, Mapletree presented the third edition of its community outreach concert series SCO Goes To VivoCity which featured more than 40 musicians performing compositions to more than 900 attendees.

For the second consecutive year, Mapletree supported Ground Zero 2024 organised by the NUS Entrepreneurship Society. Launched at MBC, the weeklong startathon allowed students to showcase their entrepreneurial prowess, with top three teams receiving cash prizes of S$4,000, S$3,000 and S$2,000.

Mapletree acquired a portfolio of 31 student housing assets in the UK and Germany, and an operating platform for GBP1 billion (~S$1.7 billion), which positioned the Group as one of the largest owners of student housing assets in the region.

Mapletree successfully closed Mapletree Japan Investment Country Private Trust (MAJIC), the Group’s third Japan-focused fund, seeded with three logistics development projects located in Central Tokyo, Central Kyoto and within the Miyagi Prefecture. It targets an assets under management of up to JPY110 billion (~S$1 billion) upon full deployment.

To support young talents’ passion in Chinese music, the Mapletree-TENG Scholarship 2024 was awarded to six recipients – an increase from the four awarded in the previous year. Funding of the scholarship totalled S$362,000 since its establishment in 2018.

Mapletree collaborated with Passerelles Numériques to organise an exclusive roundtable in Singapore, where industry experts discussed the adoption of Artificial Intelligence in various industries and its impact on communities.

Mapletree sponsored the inaugural Panti Bird Race Johor, attracting over 140 birdwatchers and photographers from Malaysia and Singapore to participate and raise awareness of biodiversity conservation.

Capital Management Highlights

Mapletree continues to diversify its sources of capital through private real estate funds or public-listed real estate investment trusts (REITs), as well as grow its investor pool to support new fund platforms.

S$30.7b

Total Funds Under Management

3

Singapore-listed REITs

>400

Investor Engagements

9

Private Funds In Operation

Eye On Asia: Emerging Opportunities

Co-organised and Co-sponsored Inaugural Investor Summit

Mapletree Japan Investment Country Private Trust

Successfully Closed Second Japan Logistics Development Fund

Sustainability Highlights

We are committed to delivering long-term sustainable returns to shareholders while creating a climate-resilient portfolio, enhancing social value within our workplace and community, and upholding high ethical standards.

S$8b

green and sustainable

financing secured

to date

100%

green-certified new

developments

Green Lease Leaders Award

US Logistics, Commercial, and Data Centre

150MWp

onsite renewable

energy capacity

10th Year

achieving the Wildlife

Trusts’ Biodiversity

Benchmark award for

Green Park, Reading

~43,000 trees

planted across Mapletree

assets and communities

since FY23/24